If you want inflation to drop, pay attention to the national debt.

Interest payments on the debt recently surpassed spending on defense and Medicare, according to the Committee for a Responsible Federal Budget. In the first seven months of this fiscal year, it cost the federal government $514 billion to service the debt.

Context can help. For instance, over the same time period, defense spending totaled $498 billion. Medicare cost $465 billion. The United States spent more on interest than on transportation, veterans and education combined.

This is the inevitable result of a government that refuses to exercise fiscal restraint. In just the past decade, the debt has doubled and now sits at nearly $35 trillion. That figure borders on the unfathomable.

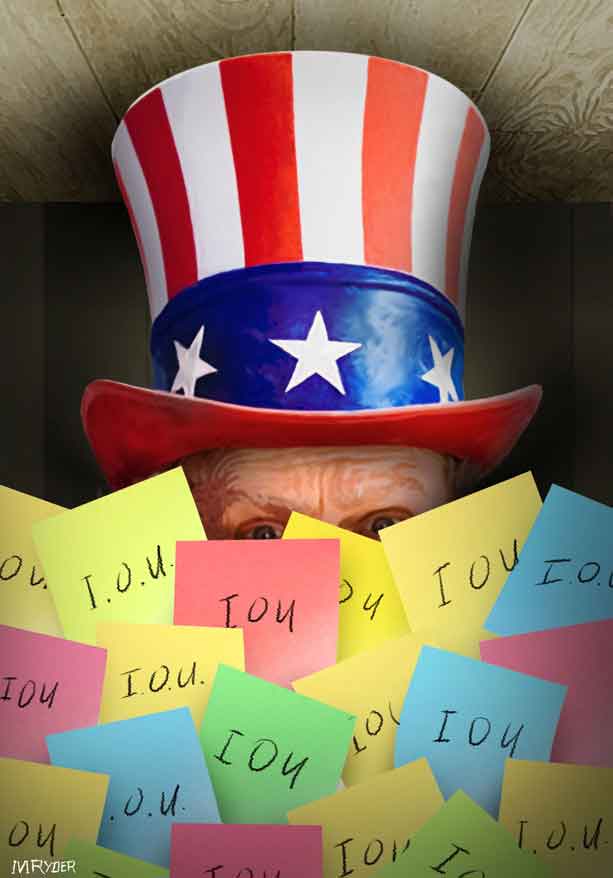

America's population is nearing 340 million. Each American's share of the interest costs now exceeds $1,500. And that's just since October. Each individual's share of the national debt is more than $100,000. That includes every newborn and retiree. If you're looking for a unique birthday gift for your grandson, consider a card with a big IOU. That's the legacy older generations are leaving their grandchildren and great-grandchildren.

The problem continues to worsen. In fiscal 2020, interest payments ran to $345 billion. Last year, it was $659 billion. By the end of this fiscal year, servicing the debt is projected to cost $870 billion.

One cause of the spike is the Federal Reserve boosting the cost of borrowing. That was a long overdue move to tame inflation, which remains significantly higher than when Donald Trump was in office. But higher interest rates don't just affect credit cards, auto loans and mortgages. They've made carrying the national debt much more expensive. Thanks a lot, Joe Biden.

The federal government won't go bankrupt. If politicians are unwilling to cut spending or raise taxes, the Treasury can print more money. But that will boost inflation, which flourishes when there's too much money chasing too few goods. The Federal Reserve can then raise interest rates, but that will exacerbate the debt burden. The government will then print more money to cover the higher costs. Absent austerity measures, this is the doom loop that leads to hyperinflation and economic collapse.

Former House Speaker Paul Ryan has warned for years that the national debt is "the most predictable crisis" in the country's history. It's not a popular opinion, but these interest payments are another reminder of how right he was.

(COMMENT, BELOW)

Previously:

•

Don't feed the pander-bear

•

'Grading for equity' leads to less learning

•

Report again highlights need for entitlement reform

•

Wage law is good news for . .. the robots

•

Joe Biden should commit to presidential debates

•

Biden tax plan would pummel average Americans

•

Iran's brazen attack on Israel was 'utterly unsuccessful'

•

More free stuff

•

Biden proposes another massive spending spree

•

Dems increasingly desperate over No Labels

•

Biden hams it up during stemwinder

•

Economies roar in red states

•

To establish 'absolute tyranny over these States'

•

Biden condemns himself in attack on shrinkflation

•

If only Taylor Swift were dating the national debt

•

Biden bows to Putin, environmentalists

•

Defenders of 'democracy' want Voter ID off ballot

•

'No one is safe if they had any hand in' Oct. 7

•

Biden infrastructure bill: A failure to launch

•

US government revenues hit record highs

•

Why Biden can't convince voters he's beat inflation

•

Why Biden can't convince voters he's beat inflation

•

Biden needs to stop the mixed messages

•

The hating class as brave defenders

•

Blinken only emboldens Hamas terrorists

•

White House green Slush fund throwing around cash

•

Biden immigration policies souring even Dems

•

Dems fret as the bad news mounts for Biden

•

Billions in coronavirus money still sitting around

•

Senate delegation reassures Israel; where's the House?

•

Senate delegation reassures Israel; where's the House?

•

Chicago takes victim blaming to an absurd new low

•

The utter failure of money to improve education

•

Group identity drives American division

•

The downside of Biden's drug price control scheme

•

WARNING: Here's why top insurers are fleeing

•

'They even laughed in my face'

•

Red states power Biden's economy

•

'If you have private insurance, you can' … OOPS!

•

Ignoring the Bill of Rights when its convenient

•

Hunter cops a plea --- but the Biden probes continue

• Will we every truly know the depth of pandemic fraud?

• Hello there, Big Brother! Please, come right in

• Its not perfect, but it's a start on immigration reform

• IRS wants to branch out

• Gas stove ban conspiracy theory comes true

• Biden's busy bureaucrats beef up regulatory state

• Don't even dare think of emulamating New Yawk!

• Where have all the nation's college students gone?

• Soft-on-crime policies hit hard wall of political reality

• Joe Biden and Monty Python is no comedy

• Global warming was supposed to wreak havoc on polar bears. Looks like someone forgot to tell the polar bears

Contact The Editor

Contact The Editor

Articles By This Author

Articles By This Author