Insight

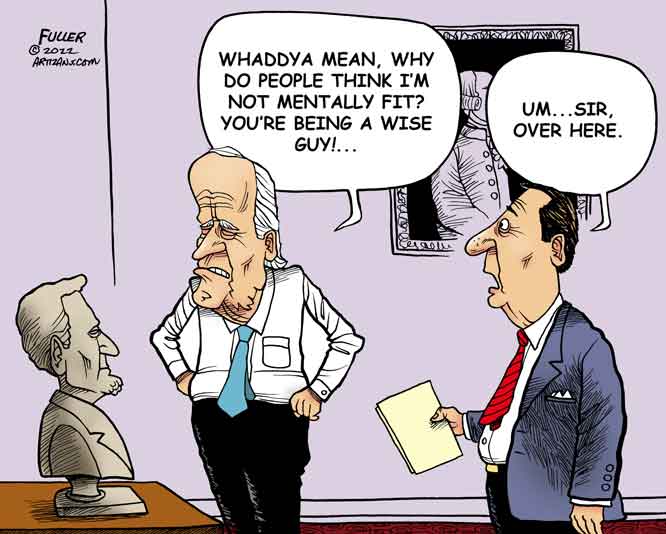

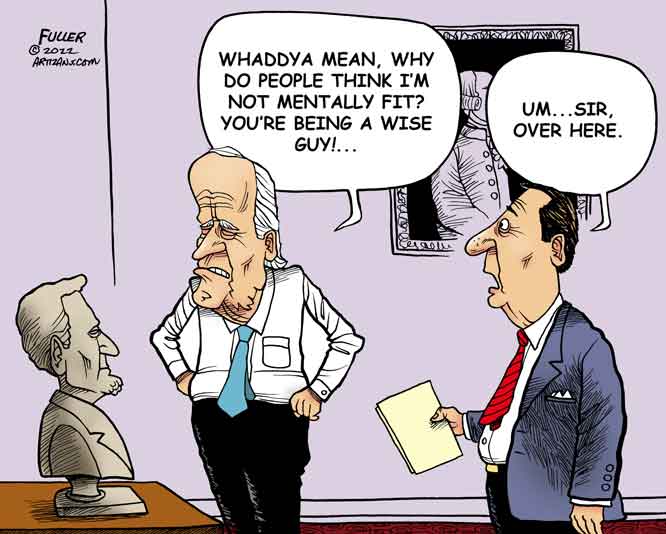

Biden has to learn the same lesson as SVB

The U.S. government has been borrowing and spending as if rates would be low forever, continuing even through 2021 and 2022. And it's still counting on low rates, if President Joe Biden's latest $6.9 trillion budget is any indication.

It was less conspicuous consumption before the pandemic when many people - policymakers and economists - argued that we could count on low rates for the foreseeable future. Some thought rates would stay low even if we spent a lot and the Federal Reserve kept printing money, behavior that historically resulted in high inflation and high interest rates. The fact that loose monetary and fiscal policy didn't produce high rates and inflation after the 2008 financial crisis added to the perception that there would be no limit on how much policymakers could spend or cut taxes.

But this made no better sense for the U.S. government than it did for Silicon Valley Bank. Years of data, and the experience of every country that's not Japan, tell us that interest rates can always change. And when they do change, it happens fast. In retrospect, there was probably some self-serving reasoning going on to justify everyone's favorite policy, whether it was more spending or lower taxes.

So much so that when inflation picked up and rates started to increase, the scope of government didn't change. In fact, it grew. The Biden administration released plans for expanding middle- and upper-middle class benefits: student debt forgiveness and generous income payment plans going forward, child tax credits even for higher earners, and expensive industrial policy that seems geared more to social goals and well-paid jobs than economic growth.

This will mostly need to be funded by debt because Biden's promise to increase taxes only for people who earn more than $400,000 will not be enough to pay for the government we already have, let alone the president's plan for more. For their part, Republicans are still gunning for tax cuts, and neither party is willing to take on entitlements like Medicare and Social Security, which will dominate our spending in the coming decades.

Our government doesn't seem to realize we're not operating in the same world anymore. Even before the events of the last few weeks, there were structural changes brewing in the economy that pointed to persistent higher interest rates. Now there are even more reasons to expect that to be the case. The Fed has suggested that it's nearing the end of its tightening cycle. Markets are even expecting the Fed to cut its policy rate later this year, even though inflation remains above 5%.

But the Fed cutting its policy rate doesn't guarantee lower interest rates. The central bank has a strong influence only on short-term interest rates, rates with a duration of less than one or sometimes two years. Longer-term rates are arguably more important - they matter for our mortgages and cost of borrowing. And those interest rates are determined by other factors in the macro economy such as the appetite for risk and demographics, inflation and inflation risk. The more inflation you expect and the more uncertain you are about that projection, the higher interest rates will be. If the Fed is indeed making inflation less of a priority as it grapples with other issues in the economy, our new reality will mean living with higher and less stable inflation and the higher rates that go with it.

It's impossible to know how high rates will go. The Congressional Budget Office expects the 10-year bond yield to be 3.8% in 10 years, but it also expects stable 2% inflation. If future inflation is 3% or 4% going forward, 5% or 6% nominal bond yields would be the least we can expect. But higher inflation rates tend to be less stable and predictable. That means more risk in the economy, and that will push yields up even higher than 6%.

In some ways, higher rates will lead to a healthier economy, one where capital is invested more thoughtfully and efficiently. It may also be possible to finally get a positive real return for your money in the bank or any other safe asset. The United States has had much higher interest rates in the past and still managed growth. Then again, in the past we also had much less government in our lives. In the 1960s and '70s, federal net spending was between 15% and 19% of GDP; in 2022 it was 24%. The latest estimates from the CBO anticipate a once unthinkable $18.8 trillion deficit over the next 10 years. And the CBO estimates interest payments will take up 3.6% of GDP by 2033, though that assumes a 3.8% interest rate. A higher rate will mean even bigger interest payments eating into our budget.

The United States is lucky its assets are considered the world's safe asset. There is no other contender in sight. Assuming the government doesn't default this year because of political battles over the debt ceiling, odds are that higher rates and uncontrolled spending won't cause an all-out debt crisis. But we do face the risk of a vicious cycle: The government tolerates higher inflation, which reduces its nominal debt, but the strategy typically also increases uncertainty and risk, which drives real rates even higher. In the end, higher interest rates and lots of spending will crowd out private-sector growth and innovation.

And then we might come to the point where the United States is forced to have the conversation it has always avoided. The size and scope of government has only grown as the country has gotten richer. That will no longer be realistic as rates rise. We'll need to pare back our expectations, accept fewer government benefits and services, and give up on the Democrats' dream of expanding entitlements, and everyone will need to pay higher taxes. The recent French experience shows just how hard cutting benefits will be. But that will soon by our reality, too.

Low rates are over, and so is our collective free lunch.

(COMMENT, BELOW)

Allison Schrager, a Bloomberg columnist, is a senior fellow at the Manhattan Institute and a contributing editor of City Journal.

Previously:

• Say it with Rubio: Changing clocks is stupid

• Sure, we'll return to the office in 2023 but not to stores

• How to manage the biggest risk of all: Uncertainty

• If you think U.S. pensions are safe, just wait

• Harry and Meghan and the perils of superstar culture

• Norman Rockwell's economy is never coming back

• Burned by crypto? Don't learn the wrong lesson

• Quiet Quitters are looking in the wrong place for meaningful work

• America's MBAs are the latest skeptics of capitalism

• Generation Z is getting a harsh lesson in stock risk

• The biggest threat to the U.S. economy is policymakers

• Buck up, boomers. You're still better off than your parents

• How to manage the biggest risk of all: uncertainty

• Startup boom is the kind of risk-taking Americans need

• Gen Z is too compliant to achieve greatness

• A bigger child tax credit isn't the poverty solution we need

• Finding your power in a higher-priced world

• The Biden administration's plans to double the tax rate on capital gains will prove costly to all Americans, not just the wealthy

• WARNING: Feel Good Now --- Pay Later: Stimulus is crammed with goodies but makes no economic sense

• The 'Stakeholder' Fallacy: Joe Biden's vision of capitalism is a recipe for failure

Contact The Editor

Contact The Editor

Articles By This Author

Articles By This Author