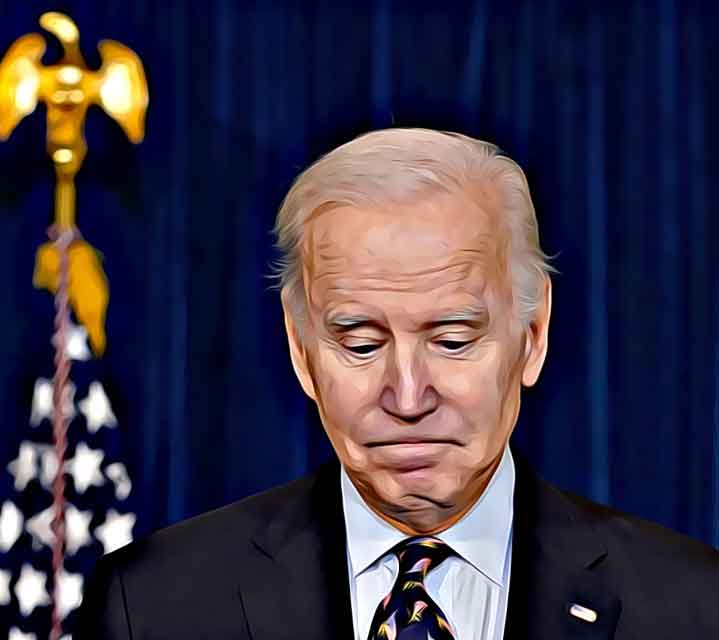

President Joe Biden will not admit that his policies, and his party's policies, have made inflation worse -- and that, if Biden and congressional Democrats had their way, they would make it worse still. He just can't say that. Instead, the president's reaction has been a mixture of denial, finger pointing, ineffective gestures and, perhaps most of all, the argument that he, as president, is virtually powerless to address the nation's most pressing concern.

"Look, inflation is the bane of our existence," Biden said when he appeared recently in a sympathetic forum, comedian Jimmy Kimmel's late-night show. Kimmel was so sympathetic that he didn't even ask Biden about inflation; Biden brought it up himself.

But he had little to say. Remember that when Biden published his plan to fight inflation in The Wall Street Journal on May 30, his first measure was not to do anything himself but to let the Federal Reserve do the job. His role as president, Biden said, was not to say anything mean about the Fed.

As for all the other, little stuff Biden is doing in the name of fighting inflation, there are reports that he knows they won't do any good. On April 12, for example, he went to an ethanol plant in Iowa to claim that alternative fuels lower energy costs. Ethanol is great, Biden said. It supports agriculture, creates good-paying jobs, reduces U.S. reliance on foreign oil and reduces the price of gasoline.

Recently, though, The Washington Post published an article suggesting that Biden knew it was all bunk. "Privately, Biden dismissed the [ethanol] policy as ineffective and questioned the value of the trip," the Post reported. "After returning to the White House, he hauled his senior staff, including chief of staff Ron Klain, into the Oval Office, badgering them with questions about the purpose of the event."

Now, the persistence of inflation has become even more serious in the last few days with the growing realization that the Fed might have to intentionally drive the nation into recession in order to bring inflation down -- reminiscent of the successful but painful inflation-fighting strategy of Fed Chairman Paul Volcker in the 1980s. "An increasing number of economists … say it may take an economic contraction and higher unemployment to bring inflation down to more tolerable levels, much less back to the Fed's 2% price target," Bloomberg reported Monday.

The Fed meets this week amid expectations that it will raise interest rates by another half-point, perhaps even three-quarters of a point. The meeting comes just a few days after the government reported inflation rose 8.6% on an annual basis in the month of May. You might have seen the many reports that characterized the increase as "unexpected," but the fact is, there has never been any consensus that inflation has peaked, and we don't know that now. It is entirely reasonable to expect more.

The price increases were particularly dramatic in the things Americans need and use most. First, food. The price of meat, poultry, fish and eggs rose 14.2% on an annual basis in May. The price of non-alcoholic beverages rose 12.0%. Dairy went up 11.8%. Cereals and bakery products, 11.6%. The price of miscellaneous food products went up 12.6%. And then the cost of eating out went up 9%.

The price of used cars and trucks went up 16.1%. The price of new vehicles went up 12.6%. The price of clothing went up 5%. The price of shelter went up 5.4%.

And then there is energy, with its astronomical increases. The price of gasoline went up 48.7%. The price of fuel oil went up an incredible 106.7%.

And what did President Biden say when the news broke that inflation hit 8.6% last month? He said, "Today's inflation report confirmed what Americans already know: Putin's price hike is hitting America hard."

Yes, the war in Ukraine is contributing to higher energy prices worldwide. But remember this: It is now generally acknowledged that Biden's policies, like the far-too-large $1.9 trillion American Rescue Plan stimulus bill, have made inflation worse. And specifically on the question of energy, clear-eyed critics knew at the beginning of Biden's time in office that his actions would lead to higher energy prices.

Just look at this article from The Washington Post on Nov. 12, 2020: "Conservatives predict gas prices will spike under Biden. Experts say those fears are overblown." Of course, the Post tried to knock down those "conservatives," but in hindsight, those fears look quite prescient. "A dubious meme has emerged online in conservative circles: The price of gasoline will spike because Joe Biden is taking office," the Post wrote. "Conservative corners of Facebook are filled with viral photos of gas stations with prices above $5 a gallon."

Imagine that! Gas above $5 a gallon! What will those crazy, fear-mongering conservatives think of next? Let's just say that article has not aged well. But the point to remember is that those (correct) predictions of rising energy costs had nothing to do with Russian President Vladimir Putin. They were based entirely on Biden's policies.

Now there are growing fears of recession. While there has been some disagreement among economists -- there always is -- about whether a recession is in fact on the way, the coming Fed actions have intensified those concerns. And that has created the fear that we might be in for a replay of the 1970s, with Biden playing the role of President Jimmy Carter.

More than half the U.S. population was born after 1980, but the older half will remember the terrible inflation and successive recessions that occurred during what former Fed chairman Ben Bernanke recently called "America's Great Inflation." How great was it? From Bernanke: "From the beginning of 1966 through 1981, the Consumer Price Index rose, on average, by more than 7% per year, peaking at over 13% in 1980. This period also saw two major and two minor recessions and an approximately two-thirds decline in the Dow Jones industrial average, when adjusted for inflation."

That was bad. Really bad. Bernanke argues that we are not in for a similarly extended period of misery, because the Fed knows more about using interest rates to fight inflation. But then again, Bernanke didn't really see the Great Recession coming, so who knows?

But one thing about the 1970s-2020s comparison rings true. Biden is indeed playing the role of Carter, although Carter, elected president at age 52, was sharp and energetic, while Biden, who will turn 80 in November, is not. Perhaps that is what prompted Republican Senator Tom Cotton to tweet recently, "These Jimmy Carter comparisons are very unfair -- to Jimmy Carter."

In any event, there was a sense, way back when, that Carter was powerless to deal with the severity of the nation's problems. Today, something similar is happening with Biden in the White House.

(COMMENT, BELOW)

Contact The Editor

Contact The Editor

Articles By This Author

Articles By This Author