This week, the stock market yo-yoed wildly, taking investors on a roller coaster of stunning lows and sudden highs. Rarely has investment been so gut-churning. And the reason for the turbulence is obvious: the Trump administration's continuing mixed signals over its trade war.

When that trade war was first announced, on April 2 ("Liberation Day"), the Dow Jones Industrial Average immediately plummeted nearly 4%; the day after, 5.5%. After President Donald Trump put a hold on the vast majority of tariffs the following week, it recovered nearly 8%. The following day, as markets realized that Trump would retain massive tariffs on China and highly elevated tariffs on many of our allies, it dropped again 2.5%.

The DJIA remained volatile but close to even for a few days — and then to open this week, it dropped almost 2.5% again, thanks to Trump's apparent threats to fire Federal Reserve Chairman Jerome Powell. And then, on Tuesday, it rose again, 2.7% — this time based on Treasury Secretary Scott Bessent's leaked statements implying that the United States would come to a trade agreement with China (a sentiment seconded by Trump), as well as Trump's statements that he would not be firing Powell.

What is the purpose of recapping this potted history? To understand a simple lesson: Volatility in policy results in market volatility. Market volatility results in lack of investor confidence. And lack of investor confidence results in economic disaster. Typically, stock prices and bond yields work in inverse, since people flee to safety from stocks to bonds, driving down yields. Yet even as the Dow Jones is off approximately 13% from its high just after Trump's inauguration, bond yields have been climbing as well — meaning that investors are showing lack of confidence in investing in American assets.

Now, taking on China is an admirable goal. And trade is certainly a chief weapon the United States could use in containing Chinese aggression across the world. But to wage a successful trade war on China would require certain preliminary steps: negotiation of strong and stable trade relationships with allies to box in China, rather than a declaration of trade war on everyone; time to reshore critical national security industries and resources, and to solidify non-Chinese supply chains; a military buildup capable of deterring Chinese action against Taiwan, which — based on the destruction or capture of semiconductor giant TSMC — could plunge the entire world into a depression and easily leave China itself at a technological advantage over the West. The Trump administration did not do this preliminary groundwork. And so the White House has been forced to punch holes in its own tariff regime, from exempting Apple products and semiconductors to unilaterally abandoning tariffs on erstwhile allies to deploying Bessent to pledge to lower tariffs on China itself.

Impulsive decision-making can be an asset in foreign policy; it's often smart to keep our enemies on their toes, unsure of what comes next. But in economic policy, impulsivity and unpredictability lead to chaos. And it's far easier for the markets to lose trust in policymakers than to regain it. China must be contained, and Trump has been singularly transformative in forcing the world to face up to that fact. But if he wishes to truly defeat China in the economic sphere, it's time for solid, understandable and methodical policy that achieves the goals Trump has correctly set forth.

(COMMENT, BELOW)

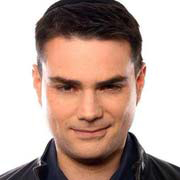

Ben Shapiro, bestselling author and syndicated columnist, first went into syndication after appearing in JWR.

Contact The Editor

Contact The Editor

Articles By This Author

Articles By This Author